Are NIE and NIF the same?

Understanding the Difference Between These Spanish Identification Numbers

If you are planning to live, work, or invest in Spain, you will soon come across the acronyms NIE and NIF. They may sound similar, but they serve different purposes within Spain’s legal and tax systems. Here’s a clear explanation of what each means and when you’ll need them.

What Is a NIE?

NIE stands for Número de Identificación de Extranjero (Foreigner Identification Number). It is a unique personal number assigned to any foreigner who has legal or economic interests in Spain — whether you plan to work, buy property, open a bank account, or stay long-term.

The NIE is issued by the Spanish National Police and printed on an official certificate with a QR code to confirm its validity. This certificate will be valid for 10 years.

You can apply for it:

- In Spain, at a National Police station or immigration office of your province in Spain, or

- From abroad, at a Spanish Consulate in your home country.

A NIE always begins with a letter (X, Y, or Z), followed by seven digits and a final letter — for example: Z-1234567-L.

What Is a NIF?

NIF stands for Número de Identificación Fiscal (Tax Identification Number). It is used for tax purposes to identify individuals and entities when dealing with the Spanish Tax Agency (Agencia Tributaria).

- For Spanish citizens, the NIF is simply their DNI number (National Identity Document).

- For foreigners, the NIF is based on the NIE — meaning that once you have your NIE, it automatically becomes your NIF for tax purposes. Example: if your NIE is Z-1234567-L, your NIF will be the same.

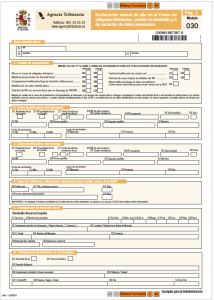

For your NIE to become active, you need to file a request at the Spanish Tax Office (AEAT) through a 030 form, submitting original and copy of your NIE certificate and Passport. You can request an appointment (cita previa) on the AEAT website.

So, Are NIE and NIF the Same?

Not exactly — but they are closely related.

- The NIE is an identification number issued by the National Police to foreigners.

- The NIF is a fiscal number used by the Tax Agency for all tax matters.

- For foreigners, the NIE number functions as the NIF when interacting with tax authorities.

Therefore, you get your NIE from the Police (for identification) and you use that same number as your NIF with the Tax Agency (for taxes).

When Will You Need Each One?

You will need your NIE for:

- Working or signing a job contract.

- Buying or renting a property.

- Opening a Spanish bank account.

- Registering with Social Security or healthcare.

- When you become Director of a Spanish Company

You will use your NIF for:

- Filing taxes or receiving invoices.

- Running a business or registering as self-employed.

- Declaring income, investments, or assets in Spain.

To avoid long cita previa delays, let us handle your NIE and NIF applications quickly and efficiently.